2nd ITMF survey on impact of coronavirus on global textiles industry

In total 34 companies from around the world participated in addition to two national textile associations with several hundred participants.

2nd April 2020

Knitting Industry

|

Zurich

Between 13-15 March 2020, the International Textile Manufacturers Federation (ITMF) conducted a survey among its members about the impact of the coronavirus pandemic on the global textile value chain, especially on current orders and expected turnover in 2020. In total 34 companies from around the world participated in addition to two national textile associations with several hundred participants.

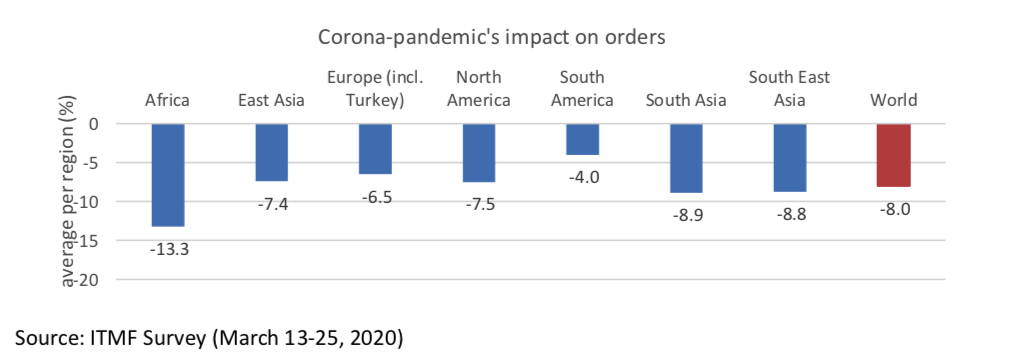

Current orders down by 8% worldwide

“The results show that on average companies in all regions of the world suffered significant numbers of cancellations and/or postponements. On world average, current orders dropped by 8.0%. The decrease in orders ranges from 4.0% in South America to 13.3% in Africa,” ITMF said in a press statement.

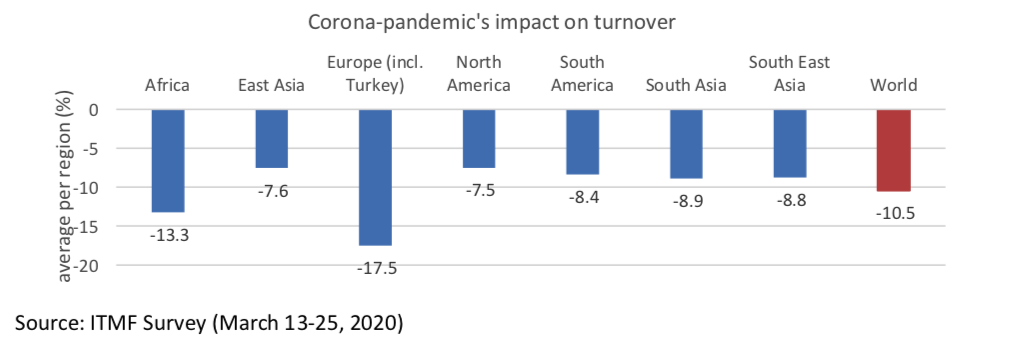

Expected turnover 2020 versus 2019 is down by 10.5% worldwide

“The results show that on average companies in all regions are expecting their turnovers in 2020 to be significantly lower than in 2019. On world average, the turnover in 2020 is expected to be 10.5% lower than in 2019. While in North America the expected plunge will be on average 7.5%, companies in Europe are expecting a drop of 17.5%.”

“It is important to note that two factors played an important role in the survey that are also interconnected with each other. These are geography and time. Those companies and country organisations that had replied early (between March 13-16) and reported about additional orders were not (yet) directly or indirectly affected by the Corona-pandemic,” ITMF said.

“With other words, these companies and organisations were neither affected by a Corona- epidemic in their own country, nor were their customers (mainly in Europe and North America). The later replies were received (from March 17onwards), the more negative were the answers across all regions.”

“It can be assumed that the fact that after March 16 more and more governments in Europe and North America introduced almost daily new regulations that were restricting public and business life (e.g. closing of kindergartens, schools, universities, shops, bars, cinemas, museums, sport facilities, ski resorts, borders, etc.) was crucial.”

“With all these restrictions in place ‘offline’ consumption of textiles and apparel in retail shops, departments stores, outlets stores, etc. dropped dramatically. This seems to have led brands and retailers across the board to cancel and/or postpone orders significantly.”

Challenges: Safety, lack of supply or demand and liquidity

Opportunities: Medical textile products

On the question of the main challenges companies are facing, companies around the world highlighted the following:

• safety and health of the workers and staff; disrupted supply chains, especially in connection with supplies from China

• lack or delay in supply in the apparel industry;

• lack of demand or the fear that demand will drop significantly;

• lack of liquidity.

With regard to opportunities, companies also mentioned:

• streamlining their internal processes during the crisis will make them emerge stronger

• companies producing fibres, yarns, fabrics and end-products with health care and protection function will see new opportunities

The results of the second survey for the period 28 March until 3 April on the impact of the corona-pandemic on the global textile industry will be released on April 6.

Business intelligence for the fibre, textiles and apparel industries: technologies, innovations, markets, investments, trade policy, sourcing, strategy...

Find out more